“Times and conditions change so rapidly that we must keep our aim constantly focused on the future.” — Walt Disney

2023 unfolded with an array of surprises. The enduring strength of the US economy was underpinned by robust employment, steadfast corporate margins, substantial cash reserves, and abundant market liquidity. Remarkably, this resilience persisted despite the relentless global interest rate hikes, ongoing conflicts in various regions, and inflation levels not seen in decades.

As we step into 2024, we anticipate significant shifts in the markets, propelling economies and equity markets alike. A global decline in inflation, driven by expectations of prolonged, slower economic growth, is reshaping demand dynamics. Furthermore, the resolute adoption of EVs and energy-efficient strategies is stabilizing oil prices alongside a deceleration in economic growth. In response to this diminishing inflation, Central Banks worldwide have pledged rate reductions throughout the year.

Yet, against this relatively sanguine backdrop, we must remain vigilant to potential market pitfalls. Escalating tensions in the Middle East, ongoing conflict in Ukraine, and uncertainties surrounding the Taiwan/China situation persist. The political climate in the US and Europe remains divisive and unpredictable, with potential repercussions for both the outcomes of conflicts and political dynamics.

In light of this context, it is crucial for investors to remember that the most significant opportunities often arise during periods of change, and 2024 promises an abundance of transformative events. Individual companies should be assessed for the potential catalysts they may offer, be it through value recognition, acquisitions, or strategic shifts necessitating change. This environment presents numerous situations capable of generating profitable catalysts for value realization.

Over the coming year, we anticipate continued declines in interest rates globally, with a clear expectation that Fed Rates may reach 4% or potentially even 3.5% by the end of 2024. This expectation is likely to keep the 10-year hovering around 4% throughout 2024. While inflation is expected to decrease, it is still likely to hover around 2%, driven by higher commodity costs and the corporate imperative to diversify supply chains.

In the context of a relatively highly valued investment environment, it becomes paramount to focus on longer-term trends to identify compelling investment opportunities. While many of these opportunities lie outside the US, we firmly believe that executing these strategies within the US provides a more secure approach. Therefore, we maintain a strong inclination towards US equities, with an allocation of approximately 80%, with 15% in Europe and Japan, and the remainder in emerging markets.

Key investment themes within the US should revolve around equities that are poised to implement the infrastructure and technology necessary to execute efficient AI strategies. This includes investments in data centers, semiconductors, and the capacity to rapidly and effectively interpret data. Other noteworthy themes for the upcoming years encompass companies dedicated to cybersecurity, carbon footprint reduction, and strategies that enhance labor productivity while maximizing the contribution of the existing workforce.

“Weekly Chart Review,” Jim Colquitt, Skillman Grove Research (2024)

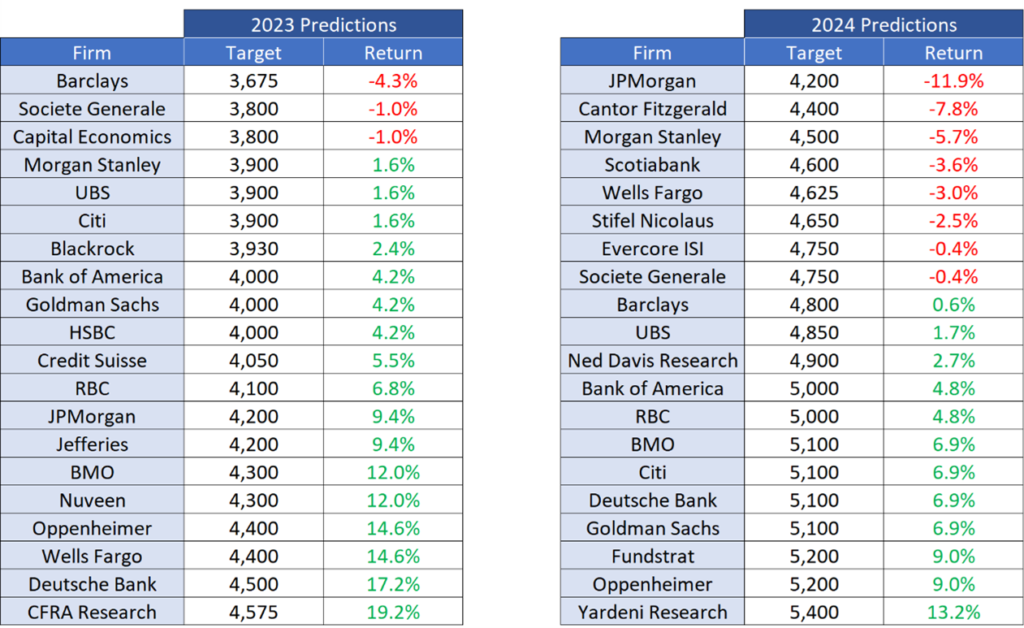

Despite the majority of brokers and investment managers predicting low single-digit returns, our perspective aligns more with the outlook of either Oppenheimer or Edward Yardeni. We anticipate that the US will navigate a first-half slowdown as higher interest rates impact employment and capital expenditures for many companies. It is worth noting that even with a forward P/E ratio of 21.6 at the end of 2023 (Evercore), most equities still trade significantly below their peak prices and valuations. This discrepancy is particularly pronounced in the case of small-cap equities, which boast a P/E ratio of 12.5.

Given the elevated levels in many technology stocks, diversifying into smaller-cap equities, as well as the energy and utilities sectors, which trade at significantly below-average multiples, offers an advantageous proposition. We also identify promising opportunities in Japanese equities and Value European equities, both of which currently trade significantly below book value.

While we do not advocate an overly concentrated position in a select few market leaders, we hold the belief that these industry frontrunners will continue to increase their revenue and achieve higher growth. Our conviction lies in the notion that the expansion of the AI footprint will extend to encompass a wide array of other technology investments, reaching across Europe and Japan. Additionally, we maintain our support for allocations into private credit and would recommend considering allocations into high yield at this juncture. The timing for incorporating venture investments into portfolios is also becoming increasingly favorable, and we anticipate a year marked by more IPOs and mergers than in the past two years.

In conclusion, as we navigate the dynamic landscape of 2024, our commitment to delivering value and results for our esteemed investors remains unwavering. We stand ready to harness the opportunities presented by change and adapt to the evolving financial terrain.

This document is being issued by Appomattox Advisory, Inc. and is for private circulation only. The information contained in this document is strictly confidential and may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Appomattox Advisory, Inc. This document does not constitute or form part of any offer of asset management products or services in any jurisdiction. Furthermore, this document does neither constitute an offer of asset management products or services.

The value of investments and any income generated may go down as well as up and is not guaranteed. You may not get back the amount originally invested. Past performance is not necessarily a guide to future performance. Changes in exchange rates may have an adverse effect on the value, price or income of investments.

The information and opinions contained in this document are for background purposes only, and do not purport to be full or complete. No representation, warranty or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Appomattox Advisory, Inc., its partners or employees and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. As such, no reliance may be placed for any purpose on the information and opinions contained in this document.

Significant differences in returns, risks and correlations may occur within sub-periods of the periods shown. Historical investment performance and market characteristics may not be indicative of future investment performance or market characteristics. There are frequently sharp differences between the hypothetical performance results and the results subsequently achieved by any particular trading or investment program.