Looking back on July and the Q2 data prints we’ve seen since the end of June, volatility seems to be rising in markets as the rally of the second quarter appears to be on hold for now. The continued global economic expansion and growing disinflationary trends of the second quarter have left a cloudy outlook, with the strong US consumer increasingly constrained by rising rates. These rising rates will impact credit-sensitive fixed income categories, especially emerging market debt and corporate high yield bonds.

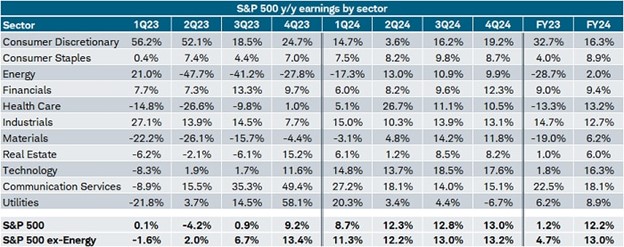

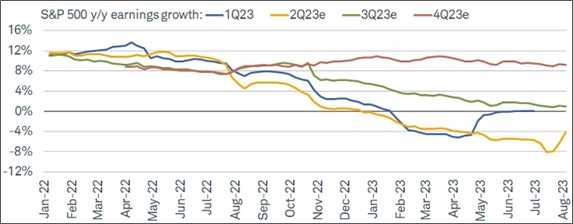

The narrow equity market rally in the US in the first half was led by the largest US stocks in the technology and communication services sectors. These stocks rose 40% in the first half of the year. However, while earnings growth was unremarkable for most sectors, Q2 earnings growth among Tech companies lagged behind stock performance (with some notable exceptions), and we expect to see a slow-down in the multiple expansion of these surging names.

Markets remained positive in July as inflation continued to slowly decline and global economies remained largely resilient, though economists have begun adjusting their growth expectations to reflect a slower-than-expected post-“Zero-Covid” re-emergence for China, and the delayed impact of the ECB’s aggressive rate hikes in the Eurozone. In the US, however, the economy’s persistent strength, paired with promising core inflation prints for June and July, inspired renewed faith in the possibility of a soft landing and supported a broad rally across asset classes in the equity markets. Technology stocks continued to lead the rally with the NASDAQ up 4% in July, and led the S&P to a 19.5% upswing for the year after ending the month up another 3.1%. The Dow Jones and Industrials remained mostly unchanged, up only 5% through July. European equites rose alongside US equities to gain another 2.2%, up 13.9% YTD through July.

Source: Charles Schwab, I/B/E/S data from Refinitiv, as of 8/4/2023.

As short-term rates are at their highest level in more than a decade, expectations are for the Fed to slow and stop hiking in 2023, with the impact on financial conditions weighing in the quarters to come. Fed Chair Powell’s remarks at his address during the Kansas City Fed’s annual symposium suggested that while another 25-basis point hike certainly remains on the table beyond the year’s end, recent prints showing core inflation rising just 0.2% YoY demand that the Fed would need to “proceed carefully” before deciding to raise rates again at the September policy meeting. While Powell noted that the recent prints were a good sign, there were “only the beginning of what it will take to build confidence” that inflation is firmly moving in the right direction, and explicitly rejected the idea that the central bank would change its 2% inflation target.

As for fixed income, we saw the Barclay Aggregate bond index pull back (0.1%), now up 2% year to date. The WTI and commodities rallied over 6% in July, leaving the Bloomberg Commodity Index down (2%) for the year. In the US, second quarter GDP came in at 2.4%, beating expectations, and headline inflation fell more than expected to 3% year-over-year. Core services inflation, excluding housing, slowed to just below 4%. The Federal Reserve followed this news with another 25 bp hike, leaving the benchmark rate’s range at 5.25%-5.50%.

Investors remain positive that inflation has peaked, and the Federal Reserve has largely completed its hiking cycle, having raised rates from 0 to 5.5% in 16 months, while selling 90 billion in bonds each month. The impact is just beginning to affect commercial real-estate, existing home sales, business spending, and retail sales. The S&P is above market multiples at 19x, while earnings are down an estimated (4.1%) year-over-year for Q2, primarily due to poor energy stock performance. This valuation, coupled with the higher cost of debt both for the Markets and the US government, has led to cautionary signs beginning to emerge in August.

Source: Charles Schwab, I/B/E/S data from Refinitiv, as of 8/4/2023.

AI developments among tech names and the CapEx this invites will likely represent the main driver of growth not only in the US but globally as well, though beyond this expectations remain muted for the remainder of the year. Insights gathered from discussions with our networks at various funds and banks have revealed expectations of a surge in sponsor-driven M&A post Labor Day. This activity will likely span various segments, including calendar-based deals, dealers linked to GTCR’s recent acquisition of Worldpay, and a broad resurgence in credit markets.

However, in the current landscape, larger strategic players are exhibiting a cautious approach, preferring to await movements by others before taking action. This dynamic highlights a tendency to hold off on major decisions, possibly attributed to the challenges of enacting substantial changes within boardrooms that are concurrently navigating workforce layoffs.

A prevailing trend within the SaaS (Software as a Service) realm involves the integration of AI functionality and tools into existing suites of products. This strategic move allows companies to expand their offerings and subsequently justify elevated pricing for customers. As a result, improved sales and earnings are anticipated for the upcoming quarters, specifically in the 4th quarter of 2023 and the 1st quarter of 2024.

Among the various tech entities, the impact of AI is likely to yield distinct winners and losers. On the winning side, the field of cybersecurity stands out. Even beyond the realm of AI, cybersecurity remains a paramount concern. AI technology enables more cost-effective and rapid execution of automated attacks, consequently heightening the demand for cybersecurity measures.

Conversely, not all sectors are poised to benefit from the advent of AI. Education and educational technology (ED-tech) sectors, along with healthcare, are identified as potential losers in this scenario. The transformation brought by AI might not align well with the intricacies of these industries, potentially leading to challenges and disruptions that could impact their success.

Overall, however, while certain sectors (like tech and consumer discretionary) may continue apace with their recent modest gains, Powell’s posturing at Jackson Hole sets a muted tone for the remainder of the year, as markets wait in anticipation of a final rate hike and for clearer signals about how long rates will stand at their current 40-year high. Given recent dislocations in the energy sector, we are considering beginning to add exposure to energy names back into portfolios—poor earnings in Q2 are largely priced into markets, and small allocations may reap outsized returns in the near to medium term. Otherwise, we anticipate that our additions to fixed income and volatility managers will serve us well for the remainder of the year while we continue gradually adding to our equity exposure.

This document is being issued by Appomattox Advisory, Inc. and is for private circulation only. The information contained in this document is strictly confidential and may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Appomattox Advisory, Inc. This document does not constitute or form part of any offer of asset management products or services in any jurisdiction. Furthermore, this document does neither constitute an offer of asset management products or services.

The value of investments and any income generated may go down as well as up and is not guaranteed. You may not get back the amount originally invested. Past performance is not necessarily a guide to future performance. Changes in exchange rates may have an adverse effect on the value, price or income of investments.

The information and opinions contained in this document are for background purposes only, and do not purport to be full or complete. No representation, warranty or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Appomattox Advisory, Inc., its partners or employees and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. As such, no reliance may be placed for any purpose on the information and opinions contained in this document.

Significant differences in returns, risks and correlations may occur within sub-periods of the periods shown. Historical investment performance and market characteristics may not be indicative of future investment performance or market characteristics. There are frequently sharp differences between the hypothetical performance results and the results subsequently achieved by any particular trading or investment program.