Through May and in early June, the latest economic data has demonstrated the remarkable resilience of the global economy, even as interest rates in developed markets continue to rise. Notably, energy prices and food commodities have contributed to a decline in headline inflation, while in the US, used car prices, which were a significant cause of inflationary pressures, are also decreasing. These trends are supporting equity markets, despite the stress observed in the banking sector.

In May, equity markets displayed mixed results, characterized by narrow breadth and significant divergence among sectors. Artificial Intelligence took the spotlight, propelling the NASDAQ 100 to a gain of 7.7%, whereas the Russell 1000 value a lost -3.9%. The S&P Index rose by 0.4% in May, while the MSCI EAFE declined by -4.1%.

Bond markets also ended the month with losses due to rising yields across the curve. The Barclay’s US aggregate declined by -1.1% during the month but has still gained 2.5% year-to-date. Notably, the 2-year treasury yield stands at 4.4%, indicating an inverse yield curve, which often signals a future recession. Commodities also experienced a decline, with WTI dropping by -11.3% in May.

Investors have observed a decrease in inflation, with expectations falling below 5%, while the labor market remains resilient. In response to these conditions, the Federal Reserve raised rates by 25 basis points in May and chose to pause in June. The US continues to exhibit economic growth, evident in strong housing starts (2.2%+) and robust employment numbers (+339,000) in May. Inflation in the Eurozone is also decelerating, with the CPI deflating from 8.5% in March to 6.9% in April and further to 6.1% in May. Germany experienced a recession in the winter, with Q4 GDP falling by -0.5% and Q1 2023 declining by -0.3%.

In Asian/Emerging markets, China’s recovery appears to have stalled following a 4.5% growth rate in Q1. The government is now looking to stimulate the economy by implementing measures such as rate cuts and infrastructure packages, given that industrial production remains at a low level of 5.8% year over year. Additionally, property tax relief for local governments is anticipated.

Globally, job markets remain robust, with unemployment rates at 3.7% in the US and 6.5% in the Eurozone. This sustains high consumer demand for services, which offsets the deteriorating manufacturing conditions faced by many countries undergoing an industrial recession. However, the looming risk of recession has created uncertainty in the markets and affected consumer confidence within the US. Persistent high inflation may lead the Federal Reserve to continue hiking rates, thereby increasing the likelihood of a recession.

Within the US equity markets, a clear divide has emerged between growth and value stocks. Growth stocks have significantly outperformed their value counterparts, indicated by the 10% spread between the Russell Growth and Value indices. This discrepancy is further highlighted by the difference between the market cap-weighted S&P Index and the equally weighted S&P, which display a similar 10% gap. The performance of the top ten stocks is responsible for 104% of the 9.4% year-to-date performance in the S&P. Suffice it to say, excluding these ten names, the markets would still be in a bearish state, so we continue to allocate equally between growth and value.  Lastly, the markets continue to closely monitor the Federal Reserve’s actions. While it was initially believed that the Fed had finished hiking rates in May, persistent inflation and strong jobs data have prompted the Fed to promise two more rate hikes this year. As we await further information before the next Fed meeting, the markets have adopted a holding pattern for now.

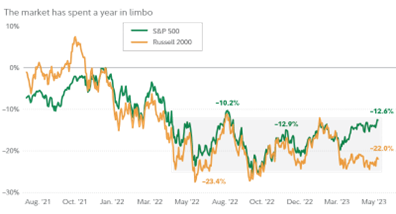

Lastly, the markets continue to closely monitor the Federal Reserve’s actions. While it was initially believed that the Fed had finished hiking rates in May, persistent inflation and strong jobs data have prompted the Fed to promise two more rate hikes this year. As we await further information before the next Fed meeting, the markets have adopted a holding pattern for now.

In our investment approach, we favor exercising caution when adding to equities, gradually averaging back into the market. We are also increasing our exposure to international markets through active management. Furthermore, we have reduced our commodity exposure and continue to decrease diversification strategies within portfolios. Finally, leveraged loans and deeply discounted REITs have been additive for many of our portfolios, allowing us to lock in higher spreads whenever possible.

This document is being issued by Appomattox Advisory, Inc. and is for private circulation only. The information contained in this document is strictly confidential and may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Appomattox Advisory, Inc. This document does not constitute or form part of any offer of asset management products or services in any jurisdiction. Furthermore, this document does neither constitute an offer of asset management products or services.

The value of investments and any income generated may go down as well as up and is not guaranteed. You may not get back the amount originally invested. Past performance is not necessarily a guide to future performance. Changes in exchange rates may have an adverse effect on the value, price or income of investments.

The information and opinions contained in this document are for background purposes only, and do not purport to be full or complete. No representation, warranty or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Appomattox Advisory, Inc., its partners or employees and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. As such, no reliance may be placed for any purpose on the information and opinions contained in this document.

Significant differences in returns, risks and correlations may occur within sub-periods of the periods shown. Historical investment performance and market characteristics may not be indicative of future investment performance or market characteristics. There are frequently sharp differences between the hypothetical performance results and the results subsequently achieved by any particular trading or investment program.