The first quarter of 2023 showed a rebound across equity and bond markets. Looking ahead at the remainder of the year, our investment focus will revolve around three key assumptions: (1) that market excesses have been largely “wrung out”; (2) that consumer and business balance sheets are generally strong and more capable of weathering a recession than in prior cycles, and (3) that a persistent high-rate environment will provide the opportunity for thoughtful, actively-managed strategies to “separate the wheat from the chaff” and identify industry leaders with the balance sheet strength and discipline to expand market share as higher costs bear down on competitors. While many of our intuitions from the start of Q2 remain unchanged, April has brought welcome clarity to our outlook.

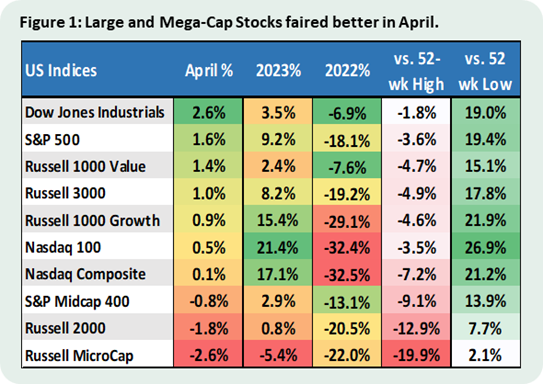

While the first quarter saw equities rally, disappointing Q1 earnings and tension around the US debt ceiling weighed on markets in April. With the first half of 1Q23 earnings prints on the board, S&P 500 companies reported their best performance relative to analyst expectations since 2021: both the number and magnitude of the earnings surprises were above their respective 10-year averages. On a total return basis, mega and large caps sharply outperformed small and micro caps (the Dow Jones rose 2.6% as the Russell 2000 and Microcap indices fell -1.8% and -2.6%, respectively (Fig. 1).

However, despite key earnings metrics running above their one-year average, companies across industries mentioned negative linearity in Q1, and rewards for earnings outperformance were well below their four-quarter average. Though many businesses have proven resilient to the increased costs of the current rate environment, a shallow recession still seems likely. Q1 GDP came in at 1.1% (below the 2.0% consensus) despite personal consumption expenditures rising 3.7%, up from 1.0% in Q4 2022. Spending on goods was up 6.5% with services spending up 2.3%. Core PCE, the Fed’s preferred measure of inflation, held steady MoM at 0.3% in March, in line with expectations. CPI MoM reported a 5.0% YoY increase vs. a 5.1% estimate. With readings remaining elevated, it’s likely the Fed will hold rates for longer.

With much of the concern around central bank hawkishness and a 2023 recession priced into markets—its 10 largest names aside, the S&P 500 currently trades at around 15.8x P/E—the outlook for DM equities appears better than at the start of the year relative to the broader equity opportunity set. With China’s economic rebound losing momentum and investors’ attention shifting back to concerns about the country’s political economic model, the near-term prospects for Chinese and EM equities have dimmed.

However, the case against the US equity Bears holds true to an even greater extent for quality European stocks. European equities are trading at significantly lower multiples than their US counterparts: the STOXX Europe 600 is trading at 13.2x P/E vs. 18.5x for the S&P1. Meanwhile, inflation in the EU, while still higher than in the US, is falling at a more rapid clip, coming down to 7.8% in March from 9.9% in February. Additionally, certain idiosyncratic factors suggest a recession in the Eurozone will be less severe than in the US: the region was less liberal with fiscal spending during and after the pandemic, has largely resolved the weaknesses in its energy supply chain, and boasts a better relationship with China, positioning it to benefit more from the PRoC’s economic re-opening as compared to the US.

In contrast to the mixed performance from equity markets, all main credit markets generated positive returns in April as markets rebounded following a volatile March. Spreads tightened as markets recovered from the indiscriminate sell-off following the events around SVB and Credit Suisse, resulting in positive total returns across investment grade and high yield. US bond yields were largely flat as the US 10-year edged down from 3.47% to 3.42% and the 2-year dropped slightly, from 4.03% to 4.01%. Global bonds returned 0.4%, driven largely by investment grade credit, which returned 1.2% over the month.

However, anxiety about the US Debt ceiling played a significant role in narratives around credit markets. Questions regarding the Treasury’s “X-date” (the date when the flexibility offered by the “extraordinary measures” taken by Secretary Yellen’s administration will be exhausted if the limit of federal borrowing is not lifted) drove trading activity. Rates in the US CDS markets are at levels not seen since the 2008 GFC.

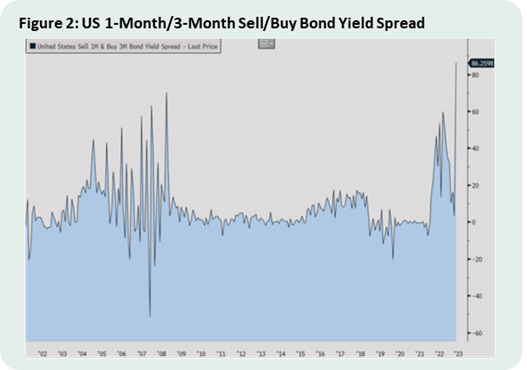

Additionally, investors are also relaying these fears in short-term treasuries, buying 1-month bills and selling the 3-month (Fig. 2). While the effective deadline will vary depending on actual government cash flows, most estimates place this between July and mid-August. Biden administration officials have said they will not prioritize payments to bondholders if the “X-date” passes without an agreement.

Nevertheless, the prospects for virtually all fixed income categories remain strong, and the asset class will prove an effective hedge against equity allocations during downturns. However, we will monitor the situation around the US Debt ceiling carefully. While a resolution is probable and the bond trading around the political gamesmanship will likely prove to be froth, treasuries markets may grow increasingly volatile the nearer we come to the “X-Date” deadline. That being said, as recent inflation readings remain elevated and the Fed appears unlikely to begin lowering rates anytime soon, the thesis around our allocations to short-term treasuries still holds.

With rates across the board at levels not seen in 16 years, well-collateralized credit investments and floating rates with short duration carry an attractive risk reward profile. In light of current spreads and with default rates of 5% already priced in, high-yield loans can also represent a safe-haven, relatively speaking, acting as an effective hedge for equity exposure. Finally, listed infrastructure investments are an excellent option for allocations at these current levels of return, given the strong support and investment from the federal government.

Lastly, we anticipate that our Diversifying Assets strategy will continue to have a significant role in portfolio construction for the remainder of 2023. During Q1, we created positive performance contributions via currency and yield curve funds and believe these managers will continue to be necessary investments in the coming volatility. Damaged sentiment toward banks will also continue to drive investors toward alternative mediums, and we expect solid return contribution to continue from funds like the iShares Gold Trust (IAU), currently up 10.1% YTD (through May 12). Additionally, we expect strong performance from volatility-driven strategies like Brevan Howard, which can provide robust uncorrelated returns given the current macro environment: the strategy specializes in managing and capitalizing on volatility in short-term interest rates as well as general market volatility and is exceptionally well positioned to capture returns connected to disruptions to the debt market.

This document is being issued by Appomattox Advisory, Inc. and is for private circulation only. The information contained in this document is strictly confidential and may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Appomattox Advisory, Inc. This document does not constitute or form part of any offer of asset management products or services in any jurisdiction. Furthermore, this document does neither constitute an offer of asset management products or services.

The value of investments and any income generated may go down as well as up and is not guaranteed. You may not get back the amount originally invested. Past performance is not necessarily a guide to future performance. Changes in exchange rates may have an adverse effect on the value, price or income of investments.

The information and opinions contained in this document are for background purposes only, and do not purport to be full or complete. No representation, warranty or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Appomattox Advisory, Inc., its partners or employees and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. As such, no reliance may be placed for any purpose on the information and opinions contained in this document.

Significant differences in returns, risks and correlations may occur within sub-periods of the periods shown. Historical investment performance and market characteristics may not be indicative of future investment performance or market characteristics. There are frequently sharp differences between the hypothetical performance results and the results subsequently achieved by any particular trading or investment program.